We speak English, Spanish, and Italian (of course!). During the past 10 years we have sold various properties in Sardinia to people from all around the world

In this article we will explain how it actually works when you fall in love with a property in Italy and you decide to make it your new home. After reading several guides out there – some are pretty good, but the majority is confusing! – we decided to add our own, written after years of field practice.

Before going into detaild we can summarize the process in 4 big steps:

Choosing the property -> Placing an offer -> Filing the preliminary agreement -> Signing the deed of sale at the Notary

From now bear in mind that every house has its own history and thus a different process. What do we mean? That the standard protocol in Italy was written to adapt to the seller and buyer needs, that in our country vary a lot from case to case.

Lets dive deep into the buying process of a property in Italy.

Purchase process

After spending weeks daydreaming about Italy, you finally decided to invest in Sardinia… what next? Before buying a plane ticket to one of the most beautiful island of the Mediterranean Sea, one must know, at least a little the process of buying a property in Italy – this will help to ease the process of buying a home in Italy.

People involved in the process

- Realtor – Agente Immobiliare, as we know it. If you don’t speak Italian we highly recommend to contact a realtor who does speak English (or your native language) to help you out with the whole process. Beware of fake realtors, in Italy, by law, Realtors need to be registered by local chamber of commerce, and they hold a patentino di agente di affari in mediazione (that is a real estate agent license). Why hire one, I speak the language and I don’t need it! – if you really speak the language and know Sardinia well, you are not going to fall in any “traps” from inflated prices, houses with hidden building abuses, missing documents, inheritance problems, cadastral map diverging from reality, and all the other issues that always pop up right before signing the final deed. We are not trying to scare anyone, this problems are usually dealt by Real Estate agents. Complications are time consuming and requires your to stay in Italy and move from one office to the other to solve them. Bear this in mind before going solo. Realtor acts as a mediator between the seller and the buyer, also he will collect all the documents the notary requests before proceeding with the purchasing process.

- Notary – Notaio. Is the public official (a lawyer specialised in public deeds) who will sign and close the deal registering your purchase, and making your new home actually YOURS by law. In Italy the buyer pays the notary’s fees, plus all taxes related to the property purchase. You are free to choose any notary from the Italian register of public notaries. We highly reccomend to chose a notarly close to town (or city) where “your new property” is located. It is also best to chose a notary that speaks English. The notary does legal checks, writes the final deed, holds the escrow bank account to receive payment for property and taxes, pays the transfer taxes to the Government, and registers the deed to the Agenzia delle Entrate.

- Lawer – Avvocato. You don’t need to hire a lawyer to buy a property in Italy, that’s what’s the notary for. But if you decided to go solo (ciao realtor!) then you definitely should hire a lawyer to help you out with all the issues of problematic property.

Documents requested in the process

1) CODICE FISCALE

The first thing you need is the CODICE FISCALE. It’s basically the Italian Tax Identification number which identifies a Tax Payer for the local Tax Authorities. If you are willing to purchase a property in Italy, or you need to open an Italian bank account a CODICE FISCALE is needed.

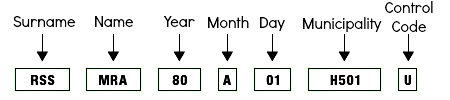

It is an identification code calculated on the basis of your surname, your names, the place and date of your birth. It will also be used to receive free medical care and assistance in Italy:

2) OPENING AN ITALIAN BANK ACCOUNT

If you decide to purchase, and you are not European it is mandatory to open an Italian bank account. It will be used to pay for the property (as the final payment normally happens in Italian bankers drafts) or request a mortgage. Bear in mind that you need it also to pay Italian taxes and utilities.

3) PURCHASE PROPOSAL

You have seen several properties, and finally you got struck by one, the one that feels perfect to you… or often the one that has 66% of what you desire (the perfect house is a unicorn). Great news! You want to buy it, and all you need to do is place a formal offer to the seller. You may decide to pay for the asking price or negotiate, talk with your Realtor if you feel like the asking price is too high, you might save some cash just with a simple question!

The Purchase Proposal – proposta di acquisto – is not binding until both parties have signed it. It is basically a contract where the realtor communicates in writing to the seller your actual intention to buy the property at a certain price and within a certain time frame, when you sign it you put a deposit to hold the house, usually 2k (or more in case of luxury property). Basically the purchase proposal is to hold the property to have time to perform surveys or ask for a mortgage and ensure that the seller won sell the property to anyone else until a set date. As a buyer, it might be convenient to hire a surveyor to check the structural state of the house. The successful conclusion of the purchase offer would be determined by the outcome of the survey. If the survey is not satisfactory, the seller will give back the deposit to you.

If you’re applying for a mortgage, proposta di acquisto, gives you the time to apply for the mortgage without the risk of seeing the house sold to someone else.

As we said, it requires a small deposit that has to be returned if the papers of the house are not OK or if the conditions you asked for cannot be met by the seller (time frame, etc)… and you may sign it via e-mail, no need to be here for proposta di acquisto.

4) PRELIMINARY AGREEMENT OF SALE

Or as we call it – Compromesso / Proposta di acquisto – is drawn up and this is a legally-binding document which states the official property data, including the agreed upon price, the closing date, the deposit amount paid, existing mortgages, what’s included (furnishings and fixtures), and any other points that need to be addressed or fulfilled.

Wait, why we didn’t skip the Purchase Proposal then? The purchase proposal is not legally needed, but it helps to hold the house while you get your paper together (codice fiscale, mortgage, etc.) and it’s the best way to negotiate the price. Sellers who see a price on paper tend to be more prone to sell the house sooner at the right price, cutting on verbal negotiation time (in Italy it can take a while, and get heated with some sellers).

The Preliminary Agreement of Sale is signed by both parties it becomes a binding document that must be followed by a down payment of 10% of the total price of the property. If you ask for a long time frame between the preliminary agreement and the final signing, some seller might require a higher down payment. The realtor now will register the Compromesso at the local Italian tax office.

What if you change your mind after signing and you don’t want to buy anymore? You will lose your 10% deposit, that’s it. You don’t have to pay for the whole property anymore.What if the seller backs out after signing? Good news for your, they have to pay back twice the deposit.

e.g. If you paid a 5k deposit you will get your 5k deposit back plus 5k compensation, that is, 10k total.

There are two types of agreement: one is a public document, the other a private contract. The notary can both drawn up public documents or authenticate private deeds.

6) FINAL DEED OF SALE

The Final deed of sale – Rogito – It is signed by both parties in person in front of the notary, the balance is paid and the property is officially transferred to the buyer who become the owner. The signing of the Rogito is the last step before buying new curtains in YOUR NEW HOME!

What if you cannot be present during the Rogito? You should give someone else power of attorney, that is, they will sign on your behalf. You may give power of attorney to your realtor, a relative, a friend, or anyone else in Italy you trust. Please be present!

RUNNING COST OF YOUR PROPERTY:

1) Purchase Costs

Buying a property in Italy costs around 10% to 20% on top of the purchase price. It may vary from case to case. Remember this when you have a budget of 120k, go for a property that cost around 100k.

• Real Estate commission

Finding your home in Italy takes time and a lot of paperwork, often there is a lawyer and a Surveyor involved… very often an interpreter… and this takes the Realtor commission around 3% of the purchase price + VAT (in Italian I.V.A.) 22% of the fee. As a buyer you pay your 3%, unless it’s a very complicated sale for a house under 200k – in that case the commission might go up to 4% – but that’s pretty rare case.

• Taxes: Land registry tax (Imposta Ipotecaria) – Cadastral Tax (Imposta catastale) – Stamp duty (Imposta di Registro)

Mandatory taxes one have to pay when buying a home in Italy. The first two are circa 50€ each (prices might vary a little from town to town).

The imposta di registro is calculated on the cadastral value of the property, that is lower than the selling price. The imposta di registro is different if you buying a second home or a first home (main residency home – you live there for 185 days a year). Second home is 9% of the cadastral value of the property, whilst as First home is 2% of the cadastral value of the property

Do not forget to tell the Realtor and the Notary that you are buying a first or second home, since it will be written on your final deed of sale. You will then have 18 months to file your residency in the house you’ve purchased. If you fail to do this, the Government will demand the additional taxes you own — plus a fine.

A) Deeds of purchase stamped at the appropriate stamp duty = if the seller is a PRIVATE OWNER – REAL ESTATE AGENCY – DEVELOPER or RESTRUCTURING COMPANY that sells after 5 years from completion of work and opts out of the VAT regime:

1. Stamp duty: – 2% for primary home (always applied on the cadastral value); – 9% for second home applied on the cadastral value if the buyer is a private entity; applied on the purchase price if the buyer is a business entity >> €1,000 is its minimum payment due.

2. Land registry tax: €50 (fixed rate)

3. Cadastral tax: €50 (fixed rate)

B) Purchase subject to VAT (Value Added Tax) = if the seller is a DEVELOPER or RESTRUCTURING COMPANY that sells within 5 years from completion of work or that sells after 5 years from completion of work and opts to charge VAT on the sale:

1. VAT (applicable on the purchase price agreed and stated in the act by the parties): – 4% for primary home; – 10% for second home; – 22% for luxury home.

2. Stamp duty: €200 (fixed rate)

3. Land registry tax: €200 (fixed rate)

4. Cadastral tax: €200 (fixed rate)

5. Duties: €230 (fixed rate)

6. Land registry fee: €35 (fixed rate)

7. Cadastral fee: €55 (fixed rate)

• Notary Fee

A fee is paid to the Notary for the preparation of the Rogito and generally only the buyer pays for the notary expenses and taxes paid to the notary as public collector.

But note that notary fees can also be requested for the preparation of the preliminary agreement of sale (and therefore not only for the deed) if the parties involved decide to also produce the compromesso with the notary in order to register a certified copy of the deed with the Land Registry.

This fee can slightly vary from town to town, and is on a scale related to the declared value of the property, to the difficulties of the deed and of the property. However notary fees are similar in every city, at least in terms of the notarial system. A notary’s office in the centre of Milan for instance could obviously apply higher fees than a notary’s office located in a country town, but this would mostly occur when operating expenses are taken into consideration – which are higher in big towns and smaller in little villages – and not with regards to the notarial rate which always remains the same.

• Other fees:

They may include the help of a lawyer for legal issues; a surveyor or an architect for the property inspection; a translator and a moving company. Also consider mortgage fees in case you need to establish a loan.

2) Annual Taxes on the Ownership of a Property

• IMU (imposta municipale): it won’t be charged on primary homes unless you own a luxury home.

IMU is applied on the cadastral value of the property plus a revaluation of 5%. The result is multiplied for the cadastral coefficient. Then you must multiply the result for the tax rate, which each municipality may decide to decrease or increase by 0.3%.

• TARI (refuse/garbage tax): all home owners, both resident and non-residents, must pay for this tax which is mainly calculated from the property square metres, the number of family members residing in there, the property type, etc. You will receive the notification of the payment each year from the municipality (comune) where the property is located and you can decide if you want to pay it as a one-off payment or dividing it into three instalments.

In case of renting out your property for a long period of time, the tenant will only pay for TARI.

There could be some cases in which you may benefit from some reductions or exemptions.

So we strongly advice the potential buyer to verify the exact rate applied by every municipality on each one of these taxes since it may vary from town to town, from case to case, and depending on different situations (e.g. introduction of new regulations).

We strongly advice the potential buyer to verify the exact rate applied by every municipality on each one of these taxes since it may vary from town to town, from case to case, and depending on different situations (e.g. introduction of new regulations).

• Utilities

Electricity, water, gas/oil etc for heating, phone: usually a small fixed fee every two months, plus payment for utilities used.

• Condominium expenses:

If you buy a property which is part of a group of properties which share some communal areas – gardens, driveway, swimming pool, tennis court etc. then you will be required to pay condominium expenses. They vary as to the type and size of communal areas on the property.